Home Equity Loan or HELOC? Pros, Cons and Best Uses

One of the great reasons to own a house is the equity you build over the years. As you pay down your mortgage, the amount of equity you own goes up. That equity, in turn, can be used as collateral for a loan.

Since your home’s value is used as collateral, the rate on these “home equity loans” is often much lower than unsecured personal loans – yet you’re not restricted on how you can use the loan’s funds, unlike with auto loans or mortgages.

Generally speaking, there are two ways you can tap into your home’s value: a home equity loan or a home equity line of credit (HELOC).

What’s in a Loan

Let’s say your home has a value of $350,000and you have $100,000 left on your mortgage. That means your home has $250,000 in equity.

Lenders will let you borrow up to a portion of that equity, but some also have options let you borrow up to 100%. In other words, using the example above, you could borrow up to $250,000 at a great rate and use that money for anything.

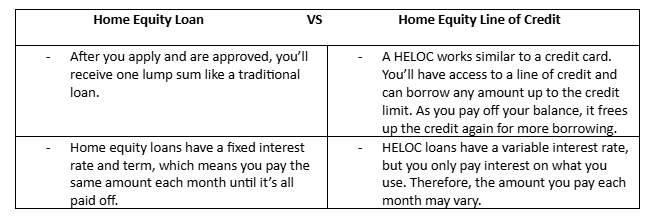

When comparing home equity loans vs lines of credit, there are key differences in how they work and what they’re best used for.

Additionally, HELOCs have two phases: a draw period, when you can borrow funds, followed by a repayment period, when you must pay down your accrued balance. Many lenders allow you to make interest-only payments during the draw period, which is typically about 10 years. Once the draw period ends, you can’t borrow from your HELOC anymore.

The Pros and Cons

Home equity loans and lines of credit carry many of the same pros and cons as other lending options. No matter what, you’ll be taking on new debt. This requires a hard check on your credit history, plus it decreases the overall age of your debt – both of which affect your credit score.

If you’re struggling with debt in general, another loan won’t necessarily address the root cause of your issues. Plus, with your home’s value as collateral, failure to repay this loan could put your living situation at risk.

Sometimes, things just get out of hand or keep piling up. But if you’re routinely going into debt, that’s a sign that you should take a look at your lifestyle choices and make some changes.

That being said, if a new loan is your best course of action for your finances, a home equity loan or HELOC could be one of your better choices. As mentioned above, your home equity loan or HELOC rate will likely be much lower than other traditional lending options. This means you’ll be paying less on interest over the life of the loan.

According to Forbes and bankrate.com, the average rate on a credit card can be over 20% higher than the rate on a home equity loan! Especially if you need to carry a larger balance, a lower rate can only help.

With a lower rate on a larger balance, you may find it much easier to manage your debt. A home equity loan’s fixed rate and term gives you a consistent repayment schedule. Additionally, you may be able to refinance your HELOC’s balance into a home equity loan down the line for easier repayment.

The Best Way to Use Each

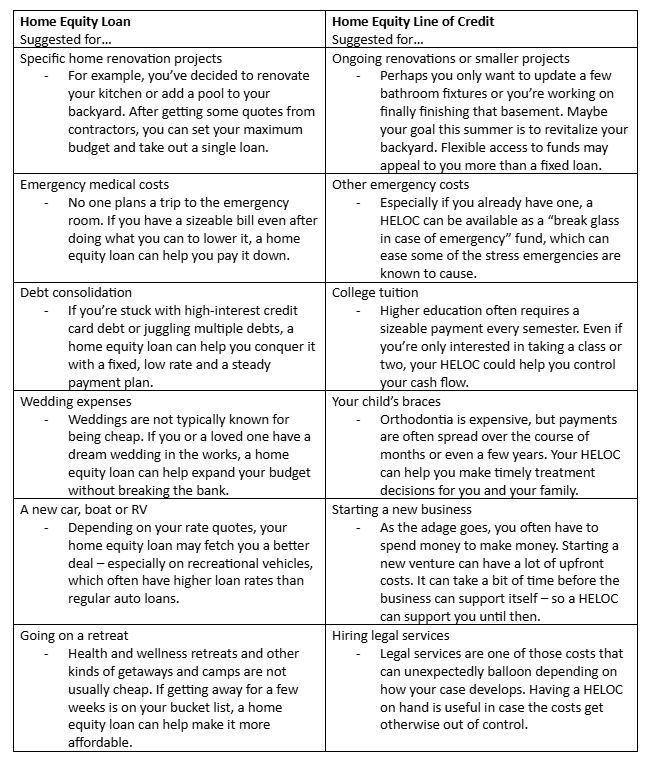

Contrary to popular belief, home equity loans and lines of credit are not limited to just home improvements or repair costs—they can be used for anything. Yet due to their different structures, one loan may be a better option than the other depending on your plans for the funds.

Home equity loans are better for large, one-time expenses. Meanwhile, HELOCs are better equipped to handle recurring costs, or projects where the cost could change dramatically. Still, there is definitely some overlap, and each loan could feasible cover anything from both lists. Check out the chart below for some examples.

Still not sure what’s best for your situation?

We always encourage talking to a financial professional before making big money decisions. Feel free to give us a call or stop by a branch. We’re happy to sit down with you and construct a plan that works for your needs. We’re here for you!